Understanding the Kasambahay Law (Part 5): Pag-IBIG or HDMF Employer Registration

So we are already registered as household employers with SSS and Philhealth. We have also registered online for Pag-ibig but has yet to receive our Employer Number.

This is now Part 5 of our quest to understand and comply with the Implementing Rules and Regulations of the Batas Kasambahay. Please click on the links to visit my previous posts.

Understanding the Kasambahay Law (Part 1): Implementing Rules and Regulations and QA released by DOLE, NSO birth certificate

Understanding the Kasambahay Law (Part 2): Guide to SSS Registration as a Household Employer and for the Household Employees

Understanding the Kasambahay Law (Part 3): SSS Payment of Contributions and Submission of Contributions Collection List

Understanding the Kasambahay Law (Part 4): Philhealth Registration

Employer Registration

Pag-ibig or HDMF registration can be done online via www.pagibigfund.gov.ph and click on e-services.

Step 1 - Select employer registration to register as household employer.

Step 2 - Fill up the employer's registration form

Here's the instructional page for employer's online registration system:

10. The system adopts a session time-out of 15 minutes to prevent misuse. If you encounter this, simply log-in again and start over with filling up information.

The Successful Registration page shall indicate that the registration process was completed.

Step 3 - Print the Employer's Data Form (EDF) and submit to the Pag-ibig Office (so that you will be issued your Pag-ibig Number) together with the following documents and the initial payment of contribution:

2. Proof of registration with the SSS (duly stamped received R-1 and R-1A)

3. Accomplished Member's Data Form (MDF) for your household helper/s

4. Members Contribution Remittance Form (MCRF)

Alternatively, you can fill up the manual Employer's Data Form and submit the same to a Pag-ibig Office.

You may also refer to the registration process flowchart in the pag-ibig website.

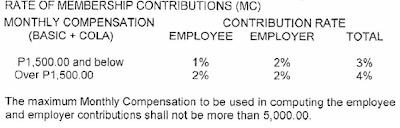

How much is the contribution?

The Kasambahay law requires the employer to shoulder the whole contribution if the salary of the helper is less than P5,000. For example, if your helper receives P3,000 salary, the contribution the employer has to shell out is P120 per month or 4% of P3,000. That's P20 more than our own employers contribute for us!

I'll make a separate post on the household helper online registration with Pag-ibig.

This is now Part 5 of our quest to understand and comply with the Implementing Rules and Regulations of the Batas Kasambahay. Please click on the links to visit my previous posts.

Understanding the Kasambahay Law (Part 1): Implementing Rules and Regulations and QA released by DOLE, NSO birth certificate

Understanding the Kasambahay Law (Part 2): Guide to SSS Registration as a Household Employer and for the Household Employees

Understanding the Kasambahay Law (Part 3): SSS Payment of Contributions and Submission of Contributions Collection List

Understanding the Kasambahay Law (Part 4): Philhealth Registration

Employer Registration

Pag-ibig or HDMF registration can be done online via www.pagibigfund.gov.ph and click on e-services.

|

| Click on E-SERVICES |

Step 1 - Select employer registration to register as household employer.

|

| Click on Employer Registration |

Step 2 - Fill up the employer's registration form

Here's the instructional page for employer's online registration system:

| 1. The REGISTER EMPLOYER Data Entry Page (Head Office/Branch Office) shall facilitate the data entry and capture of the Employer’s information. | |

| 2. Listed below are the required information that must be provided: | |

| |

| 3. The additional information that may be captured by the system are as follows: | |

|

| 4. Below listed fields accept the characters dash (-) and apostrophe (‘) | |||||||||||||||||||||||||||||

| |||||||||||||||||||||||||||||

| 5. The following fields do not accept special characters (i.e. - , / , . , “ , ’ , etc.): | |||||||||||||||||||||||||||||

| |||||||||||||||||||||||||||||

| 6. Only Numeric values are acceptable in the following fields: | |||||||||||||||||||||||||||||

| |||||||||||||||||||||||||||||

| 7. Email address should contain the “@” sign to be considered complete. | |||||||||||||||||||||||||||||

| 8. Please take note of the recommended (acceptable) abbreviations for addresses | |||||||||||||||||||||||||||||

| |||||||||||||||||||||||||||||

| 9. Please make sure to key-in the captcha or the image shown below and click the “Submit” button to execute the registration process. By clicking the Submit button, the information and all the statements provided in this registration system are being certified as true and correct. | |||||||||||||||||||||||||||||

The Successful Registration page shall indicate that the registration process was completed.

Step 3 - Print the Employer's Data Form (EDF) and submit to the Pag-ibig Office (so that you will be issued your Pag-ibig Number) together with the following documents and the initial payment of contribution:

2. Proof of registration with the SSS (duly stamped received R-1 and R-1A)

3. Accomplished Member's Data Form (MDF) for your household helper/s

4. Members Contribution Remittance Form (MCRF)

Alternatively, you can fill up the manual Employer's Data Form and submit the same to a Pag-ibig Office.

You may also refer to the registration process flowchart in the pag-ibig website.

How much is the contribution?

The Kasambahay law requires the employer to shoulder the whole contribution if the salary of the helper is less than P5,000. For example, if your helper receives P3,000 salary, the contribution the employer has to shell out is P120 per month or 4% of P3,000. That's P20 more than our own employers contribute for us!

I'll make a separate post on the household helper online registration with Pag-ibig.

Comments

Post a Comment