Paying for College – Your Award Letter

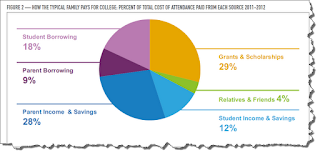

Sallie Mae just released a study conducted by Ipsos Public Affairs titled “How America Pays for College 2012”. The burden is shifting to the student, up from 25% in 2009 to now 34% in 2012. As a student, after you complete the free application for Federal Student Aid (FAFSA) form and send it to your school, the school will send you an award letter, stating scholarships, grantos, work study, and amount available through federal subsidized and unsubsidized student loans. As you start the fall semester, it is a good time to start paying on your student loans. How are you going to pay?

If you borrow money for college, you should take advantage of subsidized federal student loans before unsubsidized federal and tap private student loans as a last resort. The difference between these options is that the interest of a subsidized student loan does not accumulate until you are done with school while the interest in an unsubsidized student loan starts to accumulate while you are still in college. Private student loans have the highest interest rate; the interest and payments start immediately. But, should you borrow all you can while in college?

To me, the answer is ‘No’ to borrowing. Take full advantage of grants and scholarships – you don’t have to pay those back, but be careful of how much you borrow. Loans have to be repaid. If you don’t need it, don’t borrow it. This will require you to create and stick to a year-long budget. Once you create a budget, you can determine how much you will need to borrow for college. You can also work on campus through work-study programs which will help reduce the amount you need to borrow.

With total student loan borrowing exceeding total credit card borrowing in the United States, as a student, you will want to take a hard look at how much you should borrow for your education. Student loan money is not free money and the less you borrow, the less you will have to pay back. Complete a budget for college and seriously consider how much you need tn borrow when you get your awards letter from your school. I challenge you not to take your full award if you have to borrow on subsidized, unsubsidized or private student loan. However, if you need the money to stay in college, borrow the minimum amount so you can graduate on time.

Comments

Post a Comment